25+ FMCG Brand, Retailer & Manufacturer Speakers, 1 Case-Study Driven Day

Drive New Growth With Profitable, Shopper-Centric Retailing & Category Management Insights & Activation Strategies

9th Annual, One-Day, Industry-Led Conference & Networking Exhibition, Central London, February 2027

8th Annual, One-Day, Industry-Led Conference & Networking Exhibition, The Hilton London Canary Wharf, 12th February 2026

25+ FMCG Brand & Retailer Speakers, 1 Day: Drive Growth During Inflation In A Price-Sensitive Market – Value, Loyalty & Pricing Strategies For 2026 – Consumer & Shopper Behaviour Updates – Leveraging AI-Driven Shopper Intelligence For Growth – Retailer Insights For Enhanced, Win-Win Collaboration – Win Shoppers In An Age Of Private Label Growth – Maximise Retail Media Impact – Online Shopper Activation & Category Innovation – Unlock In-Store Convenience Success – Omnichannel Strategies To Improve Cross-Channel Performance – Sustainability & Conscious Consumerism – Unlock The Power Of Personalisation At Scale

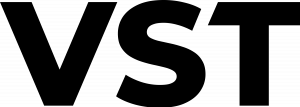

Thank You To Our 2026 Speakers...

Send 4 delegates for the price of 3 OR send 3 and get your third place half price!*

* This applies to inhouse practitioners only, not agencies and suppliers, and cannot be used in conjunction with any other discounts, including earlybird offers.

Unpack The Future Of Shopper & Category Strategies

We return in 2026 for one day of breakthrough Shopper & Category strategies from leading FMCG brands, retailers and manufacturers – our jam-packed agenda is set to deliver practical, proven strategies to translate new consumer and market insights with confidence into profitable shopper activation, retail media and category innovation.

1

Drive Growth During Times Of Inflation:

Unlock growth by balancing value, protecting margins, and reinforcing trust in a price-sensitive marketplace

2

Value, Loyalty & Pricing In A High-Inflation World:

Navigate inflation without losing shopper trust by mastering pricing strategies that deliver real value and retain brand loyalty

3

Navigate Ever-Changing Consumer Behaviours:

Leverage influencer-driven insights, and AI-powered personalisation to boost relevance and conversions

4

AI Applications Driving Shopper Intelligence:

Maximise AI to decode shopper behaviours, forecast shifts, and deliver tailored, activation-driven experiences

5

Retailer Collaboration & Insights:

Cut through the complexity of modern retail with phygital journeys and performance-led partnerships that elevate shopper loyalty

6

Brand Vs. Private Label:

Win shoppers over in a private-label world by delivering clear value, superior credentials, and trust that sets your brand apart

7

Maximising Retail Media’s Impact:

Streamline campaigns across TikTok Shop, YouTube, and RMNs to engage digitally-savvy shoppers without diluting brand value

8

Category Innovation & Shopper Activation Online:

Reimagine online category growth with seamless omnichannel journeys and unified data that anticipate shopper needs

9

Unlock In-Store Convenience Success:

Maximise performance by aligning brand and retailer strategies to engage modern shoppers through seamless experiences

10

Omnichannel Realities:

From TikTok feeds to store aisles, deliver seamless shopper experiences and optimise cross-channel performance for long-term growth

11

Sustainability & Conscious Consumerism:

Empower conscious shoppers with credible, affordable sustainable choices that cut through eco-confusion and build trust

12

Personalisation At Scale:

Unlock the practical power of personalisation by leveraging unified data and omnichannel excellence to anticipate shopper needs from day one

Brand New For 2026…

- 20+ Heads & Directors Across The Shopper & Retailer Space

- Brand New Case Studies From Sainsbury’s, Boots UK, Central Co-Op, Curry’s and more

- 3 Interactive Panels:

* Retail Media

* Consumer Behaviours

* Omni-channel Realities - Fresh FMCG Perspectives For 2026!

What Is The Commercial Value Of Attending The 8th Annual, Industry Leading Conference & Networking Exhibition?

- 25+ FMCG leaders share cutting-edge shopper and retailing strategies and debate the latest advancements revolutionising the industry

- Define your 2026 shopper strategy and gain actionable insights, all in one day at a premier venue in the heart of central London

- Emerging trends and critical topics explored from consumer behaviours to retailer collaborations, dive into curated discussions spotlighting the most pivotal shopper and retailer innovations and challenges today

- Interactive open forums and a safe space to ask your questions: 3 insightful panel discussions with industry leading perspectives

- Grow your network – 2 hours of dedicated networking breaks to make impactful connections with relevant industry peers

- Hot topics – Consumer Behaviour & Retail Media! Don’t miss your chance to equip yourself with the latest tools and strategies

- Quality speaker faculty: no pitching, just practical takeaways

- Proven return on investment: the most valuable ONE day you will have out of the office in 2026

- Brand new speakers! Fresh insights from Sainsbury’s, Central Co-Op, AO, Deliveroo, The Kraft Heinz, Coca Cola, Boots UK, and more

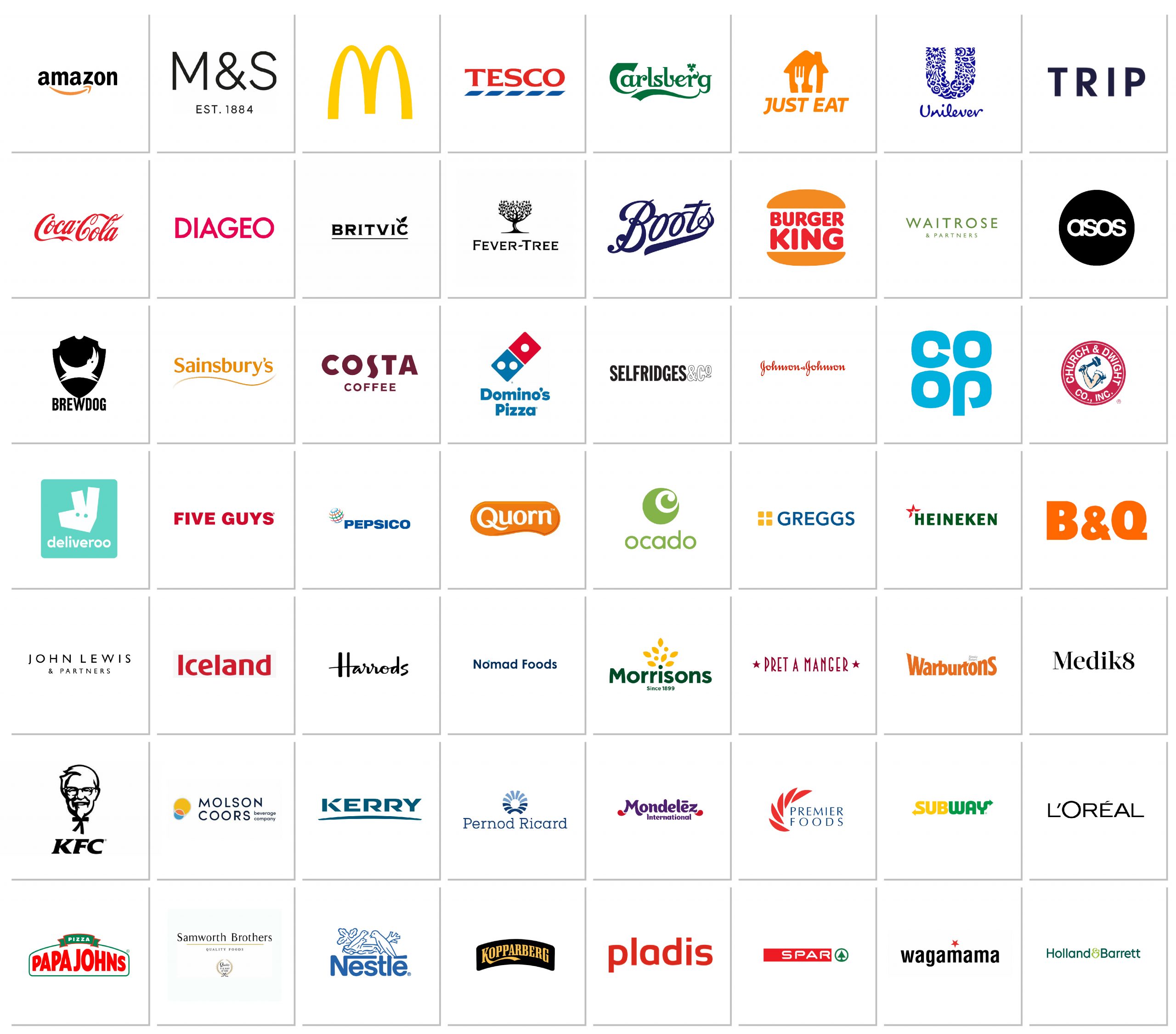

Who Attends The Shopper, Retailer & Category Insights Conference

Thank You To Our Partners...

Partner With Us – Speak, Sponsor, Exhibit Or Connect Through One-to-One Meetings At The Shopper, Retailer & Category Insights Conference

Can You Help FMCG Brands Achieve Successful Multi & Omnichannel Success?

Book An Exhibition Stand + 2 Delegate Places

Book Now For Only £3,499 + VAT & Save £1,000

Standard Rate: £4,499 + VAT

For more information on how to get involved, please call +44 (0)20 3479 2299 or email

partner@shopperinsightconference.com

Please remember to check your junk folder for the brochure – and add @gicconferences.com to your safe senders list.

Don't Just Take Our Word For It

Join Us At Our Sister Events

Global Insight Conferences is a rapidly-expanding and highly entrepreneurial conference company. We only employ individuals who are passionate about conferences, passionate about their personal growth and performance and passionate about being the best.

Please send your CV with a covering letter to hr@globalinsightconferences.com